Ensuring Video Conferencing Security: Risks, and Best Practices

In today’s interconnected digital world, secure communication is a cornerstone of successful business operations. With remote work and global teams becoming the norm, video conferencing security has shifted from being an afterthought to a top priority. As organisations embrace the convenience of video meetings, it’s crucial to safeguard sensitive information with secure video conferencing software that ensures privacy and compliance.

The demand for secure video conferencing solutions continues to grow, with Gartner projecting the enterprise video conferencing market to reach £15.2 billion by 2025. As organisations navigate this evolving landscape, investing in secure web conferencing platforms is no longer optional—it’s a necessity.

Table of contents

- Understanding video conferencing security risks

- Key factors in video conferencing security

- Privacy best practices for video conferencing

- GDPR compliance in video conferencing

- Reviewing the best video chat software for PC security

- Digital Samba's commitment to providing secure video conferencing solutions

In this article, we’ll explore the risks, best practices, and advanced solutions in secure web conferencing to empower businesses with the tools they need for safe and efficient communication.

Understanding video conferencing security risks

When it comes to video conferencing, most conference participants do not consider the security issues that may be present in a conference call. Although some of the vulnerabilities might seem quite obvious, let’s have a look at some of the most common threats:

Unsecured endpoints

Malware and phishing attacks

Participants may unknowingly download malware-infected files or fall victim to phishing attempts during conferences.

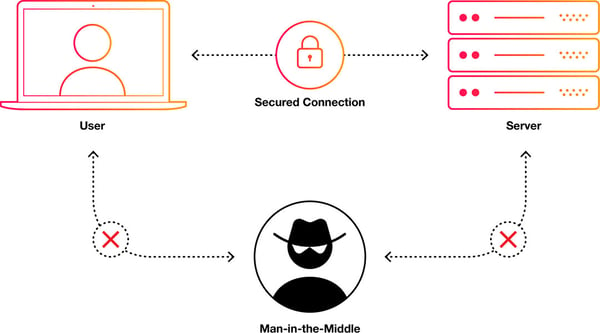

Unencrypted connections

Lack of security updates

Eavesdropping

Intellectual property theft

Data leakage

Phishing attacks

Key factors in video conferencing security

Robust encryption techniques

In the realm of video conferencing security, robust encryption techniques play a vital role in safeguarding sensitive information and maintaining the confidentiality of communications.

- Explaining the importance of encrypted video conferencing through E2EE

End-to-end encryption ensures that only authorised participants can access meeting content. This robust encryption makes secure video calls virtually impenetrable to hackers.

- Ensuring secure web conferencing communication and data protection

Implementing secure communication protocols, such as Transport Layer Security (TLS) and Secure Real-Time Transport Protocol (SRTP), adds an extra layer of protection to video conferences. These protocols establish secure connections and encrypt the data transferred between participants, preventing unauthorised interception and tampering. Additionally, employing encryption for stored data on servers enhances data protection even when not actively in transit.

Authentication and access controls

Authentication mechanisms and access controls are crucial aspects of video conferencing security, ensuring that only authorised individuals can participate in meetings and access sensitive information.

- Implementing strong user authentication mechanisms

Robust user authentication mechanisms, such as two-factor authentication (2FA) and biometric authentication, add an extra layer of security by requiring users to provide multiple forms of identification. This mitigates the risk of unauthorised access through stolen or compromised credentials and strengthens overall system security.

Keep Your Virtual Meetings Secure with Token Authentication

Read the blog

- Role-based access controls for secure video sessions, meetings and data sharing

Role-based access controls (RBAC) allow administrators to assign specific roles and permissions to participants by enforcing the principle of least privilege. This minimises the risk of data breaches or unauthorised data disclosure.

RBAC allows organisations to assign users access and authorisation to specific actions or data depending on their role. For instance, an admin may have access to all the confidential data shared within a video conference. While a participant may be allowed to take part in the call and be restricted from accessing any shared files.

Video conferencing security best practices

Minimising personal data exposure

To protect participants' privacy in video conferencing, it's essential to adopt practices that minimise the exposure of personal data.

- Collecting only essential personal information

When setting up video conferencing platforms, it's crucial to collect and store only the necessary personal information required for identification and authentication purposes. Avoid requesting excessive details that are unrelated to the purpose of the meeting. By minimising the collection of personal data, the risk of unauthorised access and potential data breaches can be reduced.

- Anonymising and pseudonymising user data

To provide an additional layer of privacy, consider anonymising or pseudonymising user data whenever possible. Anonymisation involves removing personally identifiable information, while pseudonymisation replaces identifiable data with artificial identifiers.

By doing so, you protect your participants’ data and enforce data privacy making it more difficult for unauthorised users to link data to a specific user.

Transparent privacy policies

Clear and transparent privacy policies are vital in establishing trust and ensuring participants understand how their data is handled during video conferences.

- Communicating Cpclear privacy policies to users

Video conferencing providers should communicate their privacy policies to users in a clear and easily accessible manner. Participants should be informed about the type of data collected, the purposes for which it is used, and any third parties with whom the data may be shared.

This transparency enables users to make informed decisions about their participation and assess the level of privacy protection offered.

- Providing information on data handling and retention practices

Privacy policies should also include information about how data is handled and retained. This includes details about the security measures in place, data storage locations, data center sustainability for server uptime, and the duration for which data is retained.

By doing so, organisations assure their participants that their data is being managed securely and responsibly. This also allows users to consider the associated risks and mitigation measures.

GDPR compliance in video conferencing

Understanding the General Data Protection Regulation

The General Data Protection Regulation (GDPR) is a comprehensive privacy regulation implemented in the European Union (EU) to protect the rights and privacy of individuals. It establishes strict guidelines for the collection, processing, and storage of personal data.

Ensuring video conferencing platforms are GDPR-compliant

Video conferencing platforms must adhere to GDPR requirements to ensure the protection and safety of personal data during meetings.

GDPR Compliance in Video Meetings: What You Need To Know

Read the blog

To achieve GDPR compliance, platforms should implement measures such as:

Lawful basis for data processing

Data subject rights

Data protection impact assessments

Data breach notifications

Reviewing the best video chat software for PC security

When choosing a video conferencing software that focuses on PC security, it’s important to go through its security features and ensure it matches your security and data privacy requirements. While there are hundreds of video chat software, here are some top picks that focus on security:

- Digital Samba: Known for its focus on security and privacy, Digital Samba offers advanced encryption, authentication mechanisms, and data protection features.

- Microsoft Teams: relies on E2EE to protect videos or chats from being intercepted and mandates 2FA for enhanced security and sign-on options.

- Skype: uses E2EE to protect voice and video calls, deploys a private profile ID only available to authorised users and proprietary encryption algorithms for secure chats.

Digital Samba's commitment to providing secure video conferencing solutions

When considering a secure video chat platform, integrating a VaaS like Digital Samba can significantly transform your business. Digital Samba is committed to delivering secure video conferencing solutions to ensure the privacy and confidentiality of your online meetings. With a strong focus on authentication & access control, security and data privacy, Digital Samba employs industry-leading encryption techniques to safeguard your communications.

FAQs

Video conferencing security varies by platform but generally includes encryption, access controls, and data protection measures to safeguard communications.

The most secure video conferencing platforms are those with end-to-end encryption, strong user authentication, and data privacy compliance (e.g., Digital Samba).

Secure Real-Time Transport Protocol (SRTP) is commonly used to secure video conferencing by providing encryption, message authentication, and integrity assurance for the media streams.

Ensure secure video conferencing by using platforms with end-to-end encryption, enabling strong passwords or meeting locks, and regularly updating software to protect against vulnerabilities.

A key security precaution is covering the video camera when not in use and ensuring that camera access is controlled and monitored to prevent unauthorised observation.

By choosing Digital Samba as your video conferencing provider, you can have confidence in the security of your virtual interactions with the most secure video conferencing platform.

Share this

You May Also Like

These Related Stories

GDPR Compliance in Video Meetings: What You Need To Know

Setting Up a Virtual Boardroom: Best Practices and Key Benefits